5. Putting it all together¶

5.1. Pipelining¶

We have seen that some estimators can transform data, and some estimators can predict variables. We can create combined estimators:

>>> from scikits.learn import linear_model, decomposition, datasets

>>> logistic = linear_model.LogisticRegression()

>>> pca = decomposition.PCA()

>>> from scikits.learn.pipeline import Pipeline

>>> pipe = Pipeline(steps=[('pca', pca), ('logistic', logistic)])

>>> digits = datasets.load_digits()

>>> X_digits = digits.data

>>> y_digits = digits.target

>>> pca.fit(X_digits, y_digits)

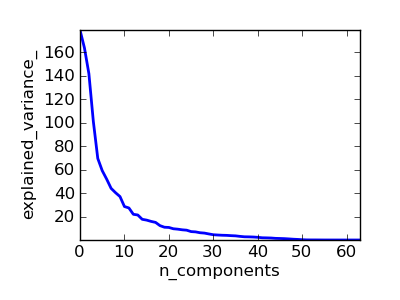

>>> pl.plot(pca.explained_variance_)

Parameters of pipelines can be set using ‘__’ separated parameter names:

>>> pipe._set_params(pca__n_components=30)

Pipeline(steps=[('pca', PCA(copy=True, n_components=30, whiten=False)), ('logistic', LogisticRegression(C=1.0, intercept_scaling=1, dual=False, fit_intercept=True,

penalty='l2', tol=0.0001))])

>>> pca.n_components

30

>>> from scikits.learn.grid_search import GridSearchCV

>>> n_components = [10, 15, 20, 30, 40, 50, 64]

>>> Cs = np.logspace(-4, 4, 16)

>>> estimator = GridSearchCV(pipe,

... dict(pca__n_components=n_components,

... logistic_C=logistic_Cs),

... n_jobs=-1)

>>> estimator.fit(X_digits, y_digits)

5.2. Face recognition with eigenfaces¶

The dataset used in this example is a preprocessed excerpt of the “Labeled Faces in the Wild”, aka LFW:

http://vis-www.cs.umass.edu/lfw/lfw-funneled.tgz (233MB)

from scikits.learn.cross_val import StratifiedKFold

from scikits.learn.datasets import fetch_lfw_people

from scikits.learn.grid_search import GridSearchCV

from scikits.learn.decomposition import RandomizedPCA

from scikits.learn.svm import SVC

# Download the data, if not already on disk and load it as numpy arrays

lfw_people = fetch_lfw_people(min_faces_per_person=70, resize=0.4)

# reshape the data using the traditional (n_samples, n_features) shape

faces = lfw_people.data

n_samples, h, w = faces.shape

X = faces.reshape((n_samples, h * w))

n_features = X.shape[1]

# the label to predict is the id of the person

y = lfw_people.target

target_names = lfw_people.target_names

# split into a training and testing set

train, test = iter(StratifiedKFold(y, k=4)).next()

X_train, X_test = X[train], X[test]

y_train, y_test = y[train], y[test]

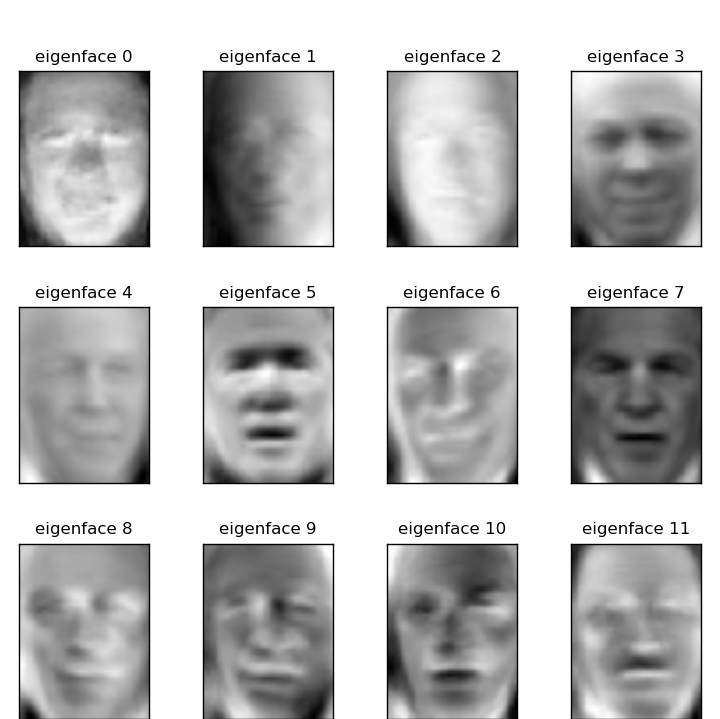

# Compute a PCA (eigenfaces) on the face dataset (treated as unlabeled

# dataset): unsupervised feature extraction / dimensionality reduction

n_components = 150

pca = RandomizedPCA(n_components=n_components, whiten=True).fit(X_train)

eigenfaces = pca.components_.reshape((n_components, h, w))

X_train_pca = pca.transform(X_train)

X_test_pca = pca.transform(X_test)

# Train a SVM classification model

param_grid = dict(C=[1, 5, 10, 50, 100],

gamma=[0.0001, 0.0005, 0.001, 0.005, 0.01, 0.1])

clf = GridSearchCV(SVC(kernel='rbf'), param_grid,

fit_params={'class_weight': 'auto'},

verbose=1)

clf = clf.fit(X_train_pca, y_train)

print clf.best_estimator

# Quantitative evaluation of the model quality on the test set

from scikits.learn import metrics

y_pred = clf.predict(X_test_pca)

print metrics.classification_report(y_test, y_pred, target_names=target_names)

print metrics.confusion_matrix(y_test, y_pred,

labels=range(len(target_names)))

# Plot the results

import pylab as pl

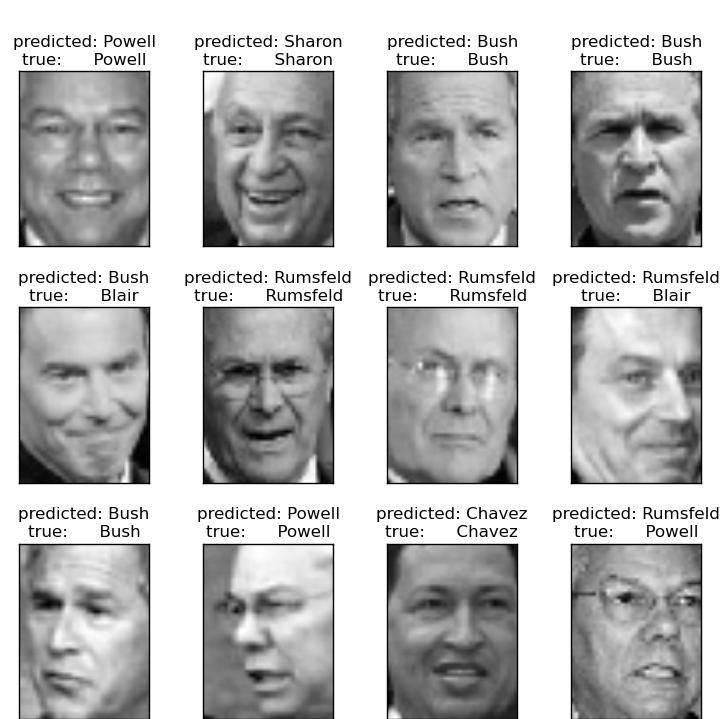

for index, (img, label_true, label_pred) in enumerate(

zip(X_test[:8], y_test[:8], y_pred[:8])):

pl.subplot(2, 4, index+1).imshow(img.reshape(h, w), cmap=pl.cm.gray)

pl.title('%s, prediction: %s' % (label_true, label_pred))

|

|

| Prediction | Eigenfaces |

Expected results for the top 5 most represented people in the dataset:

precision recall f1-score support

Gerhard_Schroeder 0.91 0.75 0.82 28

Donald_Rumsfeld 0.84 0.82 0.83 33

Tony_Blair 0.65 0.82 0.73 34

Colin_Powell 0.78 0.88 0.83 58

George_W_Bush 0.93 0.86 0.90 129

avg / total 0.86 0.84 0.85 282

5.3. Open problem: stock market structure¶

Can we predict the variation in stock prices for Google?

import datetime

from matplotlib import finance

import numpy as np

################################################################################

if 1:

# Choose a time period reasonnably calm: before the 2008 crash)

# and after Google's start

d1 = datetime.datetime(2004, 8, 19)

d2 = datetime.datetime(2008, 01, 01)

symbol_dict = {

'TOT' : 'Total',

'XOM' : 'Exxon',

'CVX' : 'Chevron',

'COP' : 'ConocoPhillips',

'VLO' : 'Valero Energy',

'MSFT' : 'Microsoft',

'B' : 'Barnes group',

'EK' : 'Eastman kodak',

'IBM' : 'IBM',

'TWX' : 'Time Warner',

'CMCSA': 'Comcast',

'CVC' : 'Cablevision',

'YHOO' : 'Yahoo',

'DELL' : 'Dell',

'DE' : 'Deere and company',

'HPQ' : 'Hewlett-Packard',

'AMZN' : 'Amazon',

'TM' : 'Toyota',

'CAJ' : 'Canon',

'MTU' : 'Mitsubishi',

'SNE' : 'Sony',

'EMR' : 'Emerson electric',

'F' : 'Ford',

'HMC' : 'Honda',

'NAV' : 'Navistar',

'NOC' : 'Northrop Grumman',

'BA' : 'Boeing',

'KO' : 'Coca Cola',

'MMM' : '3M',

'MCD' : 'Mc Donalds',

'PEP' : 'Pepsi',

'KFT' : 'Kraft Foods',

'K' : 'Kellogg',

'VOD' : 'Vodaphone',

'UN' : 'Unilever',

'MAR' : 'Marriott',

'PG' : 'Procter Gamble',

'CL' : 'Colgate-Palmolive',

'NWS' : 'News Corporation',

'GE' : 'General Electrics',

'WFC' : 'Wells Fargo',

'JPM' : 'JPMorgan Chase',

'AIG' : 'AIG',

'AXP' : 'American express',

'BAC' : 'Bank of America',

'GS' : 'Goldman Sachs',

'PMI' : 'PMI group',

'AAPL' : 'Apple',

'SAP' : 'SAP',

'CSCO' : 'Cisco',

'QCOM' : 'Qualcomm',

'HAL' : 'Haliburton',

'HTCH' : 'Hutchinson',

'JDSU' : 'JDS uniphase',

'TXN' : 'Texas instruments',

'O' : 'Reality income',

'UPS' : 'UPS',

'BP' : 'BP',

'L' : 'Loews corporation',

'M' : "Macy's",

'S' : 'Sprint nextel',

'XRX' : 'Xerox',

'WYNN' : 'Wynn resorts',

'DIS' : 'Walt disney',

'WFR' : 'MEMC electronic materials',

'UTX' : 'United Technology corp',

'X' : 'United States Steel corp',

'LMT' : 'Lookheed Martin',

'WMT' : 'Wal-Mart',

'WAG' : 'Walgreen',

'HD' : 'Home Depot',

'GSK' : 'GlaxoSmithKline',

'PFE' : 'Pfizer',

'SNY' : 'Sanofi-Aventis',

'NVS' : 'Novartis',

'KMB' : 'Kimberly-Clark',

'R' : 'Ryder',

'GD' : 'General Dynamics',

'RTN' : 'Raytheon',

'CVS' : 'CVS',

'CAT' : 'Caterpillar',

'DD' : 'DuPont de Nemours',

'MON' : 'Monsanto',

'CLF' : 'Cliffs natural ressources',

'BTU' : 'Peabody energy',

'ACI' : 'Arch Coal',

'BTU' : 'Patriot coal corp',

'PPG' : 'PPC',

'CMI' : 'Cummins common stock',

'JNJ' : 'Johnson and johnson',

'ABT' : 'Abbott laboratories',

'MRK' : 'Merck and co',

'T' : 'AT and T',

'VZ' : 'Verizon',

'FTR' : 'Frontiers communication',

'CTL' : 'Centurylink',

'MO' : 'Altria group',

'NLY' : 'Annaly capital management',

'QQQ' : 'Powershares',

'BMY' : 'Bristal-myers squibb',

'LLY' : 'Eli lilly and co',

'C' : 'Citigroup',

'MS' : 'Morgan Stanley',

'TGT' : 'Target corporation',

'SCHW' : 'Charles schwad',

'ETFC' : 'E*Trade',

'AMTD' : 'TD ameritrade holding',

'INTC' : 'Intel',

'AMD' : 'AMD',

'NOK' : 'Nokia',

'MU' : 'Micron technologies',

'NVDA' : 'Nvidia',

'MRVL' : 'Marvel technology group',

'SNDK' : 'Sandisk',

'RIMM' : 'Research in mention',

'TXN' : 'Texas instruments',

'EMC' : 'EMC',

'ORCL' : 'Oracle',

'LOW' : "Lowe's",

'BBY' : 'Best buy',

'FDX' : 'Fedex',

'FE' : 'First energy',

'JNPR' : 'Juniper',

'GOOG' : 'Google',

'AXP' : 'American express',

'AMAT' : 'Applied material',

'^DJI' : 'Dow Jones Industrial average',

'^DJA' : 'Dow Jones Composite average',

'^DJT' : 'Dow Jones Transportation average',

'^DJU' : 'Dow Jones Utility average',

'^IXIC': 'Nasdaq composite',

#'^FCHI': 'CAC40',

}

symbols, names = np.array(symbol_dict.items()).T

quotes = [finance.quotes_historical_yahoo(symbol, d1, d2, asobject=True)

for symbol in symbols]

#volumes = np.array([q.volume for q in quotes]).astype(np.float)

open = np.array([q.open for q in quotes]).astype(np.float)

close = np.array([q.close for q in quotes]).astype(np.float)

variation = close - open

np.save('variation.npy', variation)

np.save('names.npy', names)

else:

names = np.load('names.npy')

variation = np.load('variation.npy')

################################################################################

# Get our X and y variables

X = variation[names != 'Google'].T

y = variation[names == 'Google'].squeeze()

n = names[names != 'Google']